ABI January 2026: Billings remain soft to start 2026

Negotiating design fees has become more challenging in recent years.

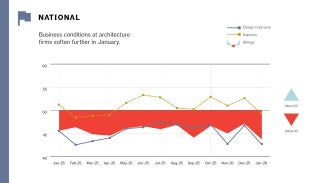

Business conditions at architecture firms remained soft to start 2026

The AIA/Deltek Architecture Billings Index® (ABI) score for the month declined to 43.8 from 47.1 last month, indicating that more firms saw a decline in billings in January than in December. In addition, inquiries into new projects declined for the first time since April 2025, and the value of newly signed design contracts also softened. There remains uncertainty among clients about starting new work, and the new projects that do get started tend to be smaller than in the past.

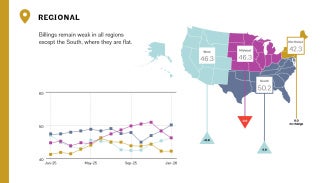

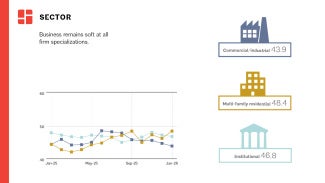

Billings declined at firms across all regions of the country in January, except in the South, where they were essentially flat. While firms located in the Midwest saw some growth in late 2025, that growth has now receded, and firms in that region are seeing declines again. Business conditions also remained soft at firms of all specializations in January, although the pace of the billings decline has slowed in recent months at firms with a multifamily residential specialization. However, these firms have still not seen any billing growth since mid-2022.

Weakness persists in the broader economy

Conditions in the broader economy remain relatively soft as well. Recent annual revisions to employment data showed smaller gains in 2025 than initially reported, and nonfarm payroll employment grew by just 130,000 in January 2026. However, construction employment was one of the bright spots for the month, adding 33,000 new positions, including 25,000 among nonresidential specialty trade contractors. This is an encouraging sign after employment was flat for much of 2025. And despite ending the year by declining by 500 positions in December, architectural services employment added a net total of 1,300 new positions in 2025, despite sharp declines in the first quarter of the year.

Optimism among small business owners declined in January, according to the National Federation of Independent Businesses’ Small Business Optimism Index. This decline followed two months of increases and was largely due to diminished expectations for hiring and capital expenditures over the coming months. In addition, the share of small business owners expecting the economy to improve declined in January.

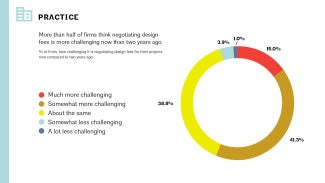

Negotiating project design fees is challenging at many firms

For this month’s special practice questions, we asked architecture firms about profitability and negotiating design fees. Overall, more than half of responding firm leaders (56%) reported that negotiating design fees for their projects is more challenging now than two years ago, with 15% reporting that it is much more challenging. Firms with annual billings of $1 million or more were the most likely to report that negotiating design fees is more challenging now (62%).

Responding firm leaders reported that professional fee plus reimbursable expenses and stipulated sum (fixed fee) are the fee determination methods that they are most likely to use regularly for design fees, as indicated by 61% and 73% of respondents, respectively. While only 24% report using the percentage of construction cost regularly, 32% report using it occasionally, depending on the project. Few firms reported using the percentage of construction cost not to exceed a fixed amount (27% use) or the fee per square foot (31% use) methods at all.

When asked to select the most profitable fee determination method at their firm over the past two years, among the methods they have used, 30% of responding firm leaders selected the stipulated sum (fixed fee) as the most profitable. An additional 25% selected professional fee plus reimbursable expenses, and 24% selected hourly rate (with or without agreed maximum). Small firms and those with a multifamily residential specialization were more likely to report that the hourly rate method was most profitable (33% and 39%, respectively).

We also asked which client types and project delivery methods are typically more profitable. In comparison to projects for other client types, responding firm leaders were more likely to report that corporate business, commercial, or industrial companies (40%); federal government, state, or local government (including public schools) (37%); and private institutions (e.g., for-profit hospitals, private schools) (34%) are quite profitable. They were most likely to report that non-profit organizations or institutions (e.g., non-profit schools and hospitals, museums, churches) (42%) and developers/private individuals (29%) are generally not very profitable when compared to other client types.

For project delivery methods, the largest share of responding firm leaders indicated that a traditional design-bid-build contract with the owner is quite profitable (34%), followed by construction manager as constructor (CM at risk) (26%), and design-build contract (25%). Public-private partnerships, on the other hand, were reported as not being very profitable by 28% of respondents.

- Join us for FREE at the next AIAU live webinar, Economic Update: Q1 2026 ABI Insights, on February 19, 2026, at 2pm ET.

This month, Work-on-the-Boards participants are saying:

- “Inquiries are strong, but for every project we win, it feels like another client is cutting back their plans or delaying project starts. I’m cautiously optimistic for the year, but that optimism won’t sustain too many more hits.”—130-person firm in the Midwest, commercial/industrial specialization

- “A month-to-month rollercoaster. Projects stalled or put on hold, in parallel with so many proposal requests that we can’t respond to them all.”—17-person firm in the South, mixed specialization

- “Things feel like they are moving in a positive direction. Although new opportunities are hard to come by locally, we’ve heard of upcoming work that is promising.”—26-person firm in the Northeast, institutional specialization

- “There is not an overwhelming amount or a dearth of work, which is good because there is a shortage of professionals.”—9-person firm in the West, multifamily residential specialization

Join the ABI Work-on-the-Boards panel to participate in our monthly survey. Open to architecture firm owners, principals, and partners. All participants get a free ABI subscription.

The monthly AIA/Deltek Architecture Billings Index is a leading economic indicator for nonresidential construction activity.

Deltek is the home of AIA MasterSpec®, powered by Deltek Specpoint. Deltek helps A&E firms boost efficiencies while improving collaboration and accuracy.