January 2026 Consensus Construction Forecast

In 2026, nonresidential construction faces slowing growth, widening sector imbalances, and continued economic uncertainty.

Ongoing uncertainty and imbalance for nonresidential building construction

Spending on nonresidential building activity over the second half of last year was disappointing. As of midyear last year, members of the AIA Consensus Construction Forecast Panel projected that spending on buildings would be up almost 2% for 2025, followed by a similar gain this year. Now, this modest forecast gain looks instead to have been a decline of a similar magnitude.

These disappointing results were evident across the board: A 1.5% projected gain in the commercial sector looks instead to have been a 3% or so decline. An expected modestly weak performance for the manufacturing sector looks instead to have been a 5% decline, and a healthy 6% projected increase for institutional building saw growth at less than half that pace, according to current panelist estimates.

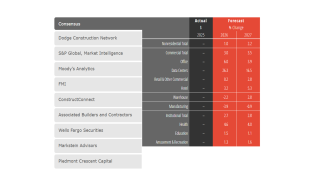

The weakness that we saw as 2025 progressed is expected to continue into this year and next. The forecast panel is projecting just a 1.0% gain in spending on building this year, increasing to just 2.2% in 2027. Since these figures are not adjusted for inflation, the modest expectations for growth likely won’t even cover increased construction costs. Within the broader building category, spending on commercial facilities is projected to increase 3.0% this year and an additional 3.5% next. Manufacturing spending is forecast to decline 3.9% this year, and an additional 0.9% in 2027. Spending on institutional facilities is expected to increase 2.7% this year, and an additional 2.8% next year.

While very modest gains may be the best description of the overall building outlook, it is not an accurate portrayal of most of the individual building categories, particularly in the commercial sector. Data centers are expected to see continued healthy gains over the next two years. In contrast, spending on traditional offices (net of data centers, which are included in the broader office category) is expected to see a steep decline both years, while spending on retail facilities, including warehouses, is expected to see almost no growth this year and only modest gains in 2027. The institutional categories tend to see more stable spending levels, but even here, health care facilities look to see gains in the mid-single digit range for the year and next, while both the education and amusement and recreation categories are likely to see almost no growth either year.

An uncertain and unbalanced economy

The overall economy is reasonably healthy. GDP is estimated to have increased slightly over 2% this past year and is projected to grow by about 2.5% this year. However, the economy has been influenced by two characteristics, uncertainty and imbalance. The uncertainty has been caused by longer-term impacts of tariffs, immigration policy, and federal government spending.

Tariff policy uncertainty has resulted from shifting policy positions. Producers and investors typically have not had much clarity as to what countries, what products, or what tariff levels might be in place over the longer term. This makes decision making difficult and often encourages inaction in supply chain sourcing and investment decisions. Construction is an industry that is particularly impacted by this uncertainty, as investments in new facilities typically play out over several years, and therefore, the lack of visibility into long-term tariff policy makes this planning very challenging.

The construction industry is impacted by immigration policy as much or more than any other industry in our economy. Of the 12 million payroll and nonpayroll employees in the construction industry, a quarter are foreign-born, and this share rises to a third for the craft workers in the industry. An estimated half of these foreign-born workers are undocumented, meaning that they are particularly vulnerable to immigration enforcement. Construction is estimated to have a higher share of undocumented workers than any industry in our economy, with agriculture being the only other industry that comes close.

The magnitude of federal government spending cuts is still uncertain, given that many face ongoing court challenges. The best estimates are that federal outlays were reduced by well over $300 billion in 2025, or almost 5% of the federal budget. About 300,000 federal positions were eliminated last year by voluntary and involuntary reductions. These reductions will ripple through the broader economy in the coming years.

Additionally, the strength of the economy is unbalanced. A few sectors, mostly related to investment in artificial intelligence, have buoyed both the stock market and the overall economy. Some economic analysis suggests that AI-related spending in the U.S. has accounted for over half of all economic growth recently. Only a relatively small share of the population has benefited from the modest growth the economy has seen in recent years. This is a key reason why consumer confidence scores have weakened. The Conference Board reports that its consumer confidence index scores dropped from 79.6 in December of 2024 to 54.9 this past November. Lower-income households, who are not seeing the economy work effectively for them, have reported much lower confidence scores recently compared to upper-income populations.

Like the broader economy, the construction sector has seen uneven growth. The surge in e-commerce during the pandemic led to a rise in warehouse construction. Federal spending on infrastructure and technology projects led to strong growth in manufacturing and construction. More recently, the dramatic growth in AI investment has led to an unparalleled rise in data center construction. For the past three years, spending on these three sectors has accounted for over 40% of all spending on building construction nationally. In 2019, the share for these three sectors was 25%.

Construction spending has stalled

The same concerns facing the overall economy —tariffs and the cost of goods, labor availability, continued high interest rates, and cutbacks in federal spending— are also impacting the construction sector. Spending on nonresidential building projects likely declined modestly last year and will continue to see headwinds moving forward.

Traditional leading indicators of construction activity are not all aligned. The AIA Architecture Billings Index® has been weak for three years. The design contracts index, which measures new project work coming into architecture firms, has been just as weak as billings, so there is no evidence that design work is poised for an upturn.

Construction starts, which measure the anticipated cost of a project at the time work begins on that project, paint a more optimistic picture for the outlook. Through the first eleven months of 2025, construction starts for nonresidential buildings increased about 5% according to one of our forecast panelists, and over 15% according to another panelist. However, project delays and cancellations have become more prevalent recently, bringing into question the actual timing of construction spending, or even whether the construction will actually occur.

Construction contractors express a degree of nervousness about the outlook. Concern over materials prices and labor availability continues. A recent survey of contractors by AGC and Sage reported that almost two-thirds of respondents say that they have had at least one project postponed, scaled back, or cancelled within the past six months. Common reasons mentioned for challenges to these projects included uncertain or reduced funding, or funding that was unavailable or too expensive. However, contractor backlogs have been easing recently. The November reading by ABC of 8.1 months of backlogs on average tied the lowest reading for backlogs since the pandemic.

Moreover, just as we have seen in the overall economy, the construction industry is unusually unbalanced in terms of its recent performance, as well as in its growth prospects. Different sectors may be described as strong, growing, stalled, or declining.

Strong: In the strong category, data centers stand alone. Spending increased by an estimated 32% last year, and our forecast panelists are expecting additional gains of 26% this year and almost 17% next.

Growing: Outside of data centers, projected growth rates drop off significantly. The best rating any other sector can command is growing, with health care and hotels falling into this category. Despite cutbacks in key health care funding programs, spending on health care facilities eked out a modest estimated increase of 1.5% last year. Given the strong demographic tailwind behind healthcare spending, namely an aging population, spending on health care facilities is projected to increase just over 4.6% this year, with an additional 4% gain in 2027.

Hotels are the other sector that can be characterized as growing, although fairly modestly. Spending on hotel construction collapsed during the pandemic, and the industry is still recovering. However, business travel continues to pick up, as a recent survey reported that three-quarters of firms increased their travel spending last year, with two-thirds predicting that spending this year will outpace last year. The forecast is for hotel construction to grow by just over 3% this year before accelerating to 5% growth in 2027.

Stalled: A large number of construction sectors currently fall into the stalled category, indicating that projections are for no growth, or growth below the anticipated rate of inflation in the costs of construction. Education, retail, warehouses, and amusement and recreation fall into this category.

The disappointing projections for the education market are the result of three trends. The first is that the federal government has been cutting back on research funding to colleges and universities. The second is immigration policy, which is discouraging foreign students from attending U.S. colleges and universities. However, the most critical factor is basic demographics. The Census Bureau projects that between 2025 and 2035, there will be 600,000 fewer 5- to 9-year-olds nationally, 1.5 million fewer 10–14-year-olds, 1.9 million fewer 15–19-year-olds, and 1.0 million fewer 20–24-year-olds. This will limit the need for new construction in this sector but increase the need for reconstruction of older facilities. After a very modest decline in spending in this category last year, our forecast panel is projecting only very modest gains this year and next.

The modest projected gains in construction spending in the retail category, warehouses, and amusement and recreation facilities are likely the result of the weak consumer confidence outlook. Additionally, the warehouse sector was overbuilt in many areas during the pandemic, while the amusement and recreation sector is slowing after strong growth in recent years.

Declining: Two sectors, moving in very different directions in the long run, currently fall in the declining category: manufacturing and offices. Manufacturing construction spending has seen phenomenal growth in recent years, increasing by over 50% in 2022, another 62% in 2023, and then another 16% in 2024. However, growth paused last year as spending in this category fell about 5% and is projected to decline another 4% this year and 1% in 2027. The longer-term prospects look much more promising, as construction starts for manufacturing projects have shot up again. Since many of these starts are for megaprojects, such as large semiconductor fabrication plants that entail a complex construction process, it may take a while before the activity shows up in the construction spending data.

With remote work continuing to be a popular option nationally, the demand for office space has fallen significantly. Cushman and Wakefield report that the national office vacancy rate was 20.5% at the end of 2025, up from 20.2% at the end of 2024, and from around 15% five years ago. This has not only reduced the pace of construction for offices but also has encouraged the conversion of office space to other uses, particularly housing. Netting out data center spending from the Commerce Department’s office construction spending figures, the AIA forecast panel is projecting spending declines in the double-digit range for office construction both this year and next.